- Home

- /News & Events

- /News

- / ADB, FOREIGN TRADE BANK of CAMBODIA P...

ADB, FOREIGN TRADE BANK of CAMBODIA PARTNER TO SUPPORT MSMES THROUGH TRADE AND SUPPLY CHAIN FINANCE IN CAMBODIA

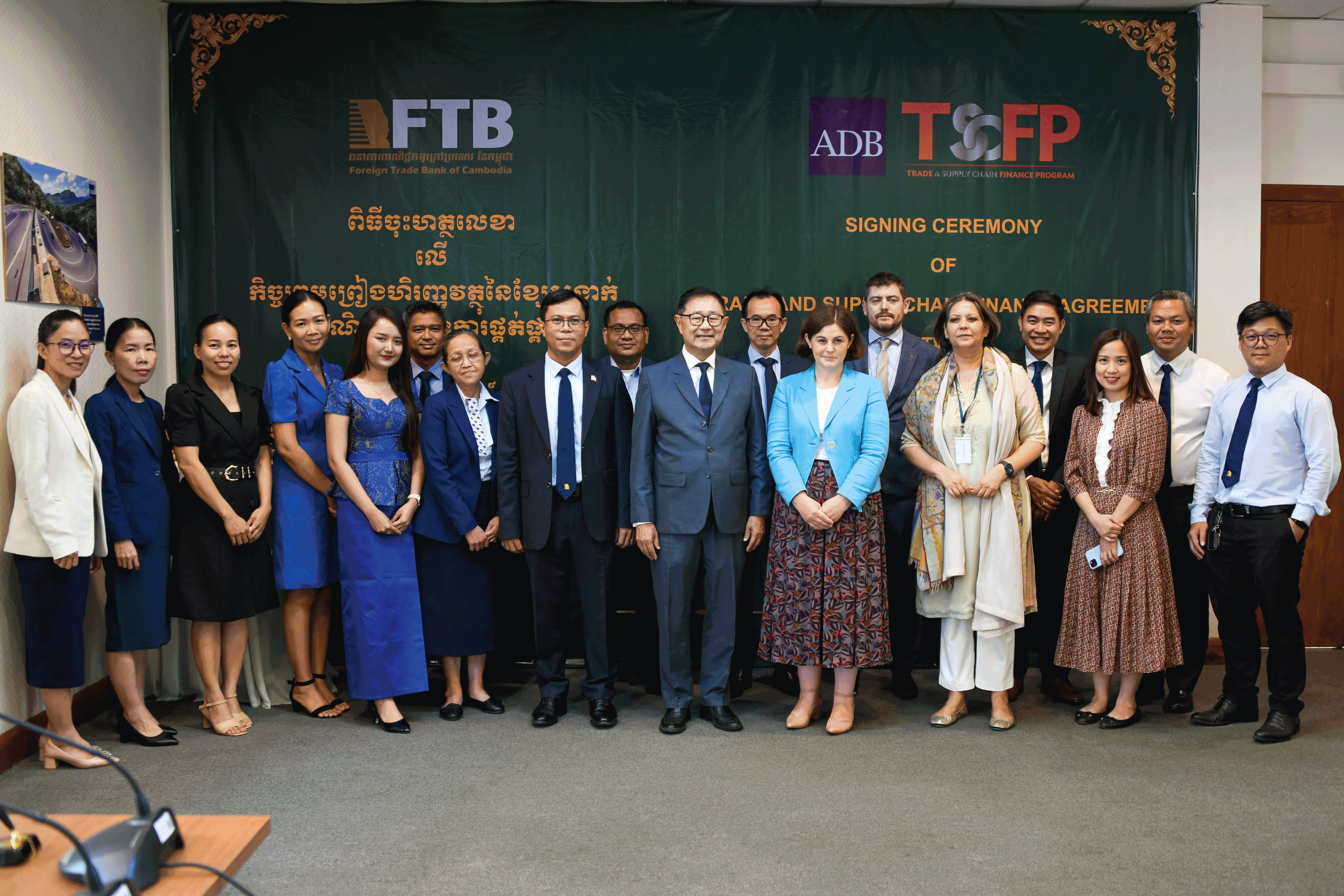

PHNOM PENH, CAMBODIA (6 February 2024) — The Foreign Trade Bank of Cambodia (FTB) has joined the Asian Development Bank’s (ADB) Trade and Supply Chain Finance Program (TSCFP) to boost trade finance in Cambodia, especially for the country’s micro, small, and medium-sized enterprises (MSMEs).

ADB Country Director for Cambodia Jyotsana Varma and FTB’s Chief Executive Officer Dith Sochal signed the deal today at ADB’s Cambodia Resident Mission in Phnom Penh.

“The agreement is part of ADB’s private sector development initiative to promote the sector’s participation in Cambodia’s economic diversification,” said Jyotsana Varma. “It will fill market gaps by providing financing through partner banks to support trade and MSMEs, representing about 99% of all enterprises in Cambodia.”

As a partner bank of TSCFP, FTB will provide support to corporate and MSME clients in Cambodia by allowing trade finance instruments issued by FTB to be covered by TSCFP’s credit guarantees. This assistance is expected to help increase the number of international banks engaged in the Cambodian market.

“With this Trade and Supply Chain Finance Agreement, we aim to facilitate and extend wider and more competitive ranges of trade finance products to our customers, by making trade and supply chains inclusive and sustainable. Trade finance is an important instrument for our trading client bases, and is also a vital tool for enhancing our country’s trade competitiveness and creating jobs,” said Dith Sochal.

“By working together with ADB, we will be able to access more resources, expertise, and opportunities to provide better and more competitive and innovative trade finance solutions to our customers, and to help make further contribution to the development of Cambodia’s trade sectors.”, he added.

Trade is an essential part of economic development in Cambodia, and this new collaboration will provide further opportunities to expand support for regional and international trade and commerce. ADB is one of the country’s largest sources of official development assistance, with an average annual lending of $363.28 million from 2019 through 2023.

To make the collaboration as effective as possible, FTB has already been working with TSCFP to boost its knowledge and skills in trade facilitation. TSCFP has helped build capacity within FTB on report preparation, good practices, innovative strategies, training modules, and performance measurement.

Backed by ADB’s AAA credit rating, TSCFP provides loans and guarantees to more than 200 partner banks to support trade, boosting imports and exports that foster growth. Since 2009, TSCFP has supported $57 billion in trade in more than 45,000 transactions in emerging markets.

About FTB: As the first commercial bank in Cambodia, a truly local bank trusted since 1979, FTB has played crucial roles in helping to promote and develop the local market and economy through relentlessly providing wide ranges of banking products and services to local customers. With its total assets increasing to US$1.94 Billion, total loan portfolio of US$ 1.27 Billion and total deposit of over US$ 1.61 Billion, FTB is committed to continually helping local customers to achieve further growth and prosperity, and steadily forging ahead with the vision to be the preferred commercial bank in Cambodia.

© 2024Foreign Trade Bank of Cambodia

|

Site Map

English

English ភាសាខ្មែរ

ភាសាខ្មែរ